Image Source – NPR

Introduction

On June 10, 2025, the United States and China emerged from two days of rigorous trade discussions at London’s Lancaster House, striking a preliminary accord to dial back economic friction. This agreement builds on a foundation laid in Geneva in May 2025, aiming to loosen export restrictions, preserve a tariff ceasefire, and tackle pressing matters like rare earth minerals and educational exchanges. Still, it hinges on the final nod from Presidents Donald Trump and Xi Jinping—a reminder of its fragile status.

Alongside this, the US is pressing forward with plans to distance itself economically from China while breathing new life into its domestic manufacturing through global partnerships and bold industrial strategies. This piece unpacks the London talks, stakeholder responses, and the wider currents of US-China decoupling and America’s manufacturing renewal.

London Trade Talks: Key Players, Venue, and Strategic Goals

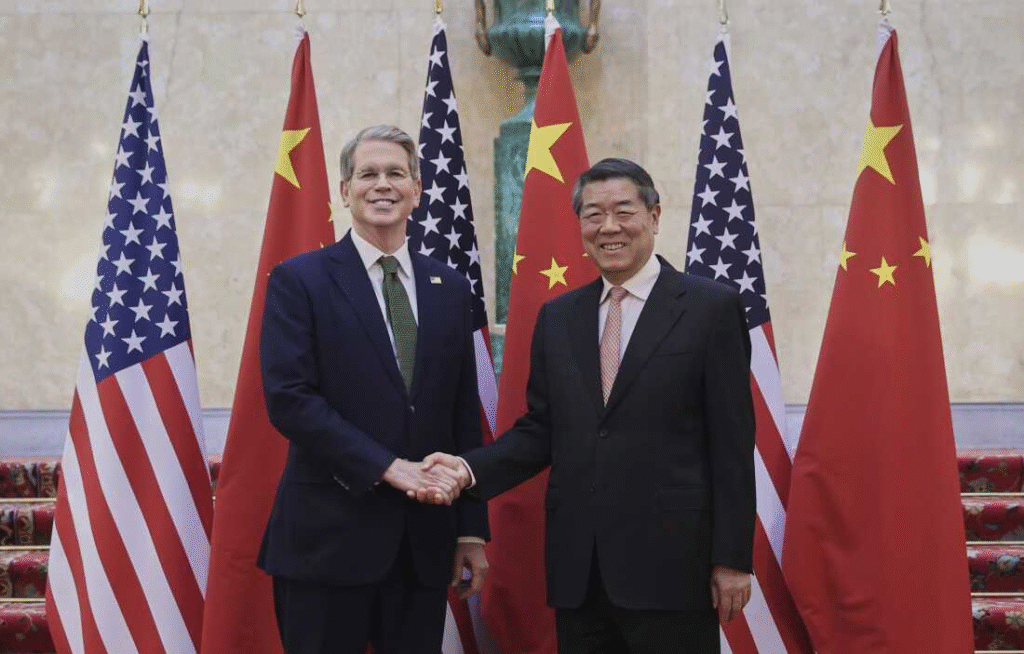

Held at the storied Lancaster House, the negotiations drew high-level officials from both sides. The US contingent featured Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and U.S. Trade Representative Jamieson Greer. China sent Vice Premier He Lifeng, its economic policy steward, alongside Vice Commerce Minister Li Chenggang. The talks stretched into the early hours, zeroing in on fleshing out and extending the Geneva pact from May 2025, which had locked in a 90-day tariff freeze due to lapse in August.

Inside the Deal: Key Provisions of the 2025 US-China Trade Agreement

The framework hammered out includes several pivotal elements:

Easing Export Controls

The US pledged to pare back select export limits, particularly on tech and goods, with careful calibration. China, in turn, agreed to ease its grip on rare earth minerals and magnets—lifelines for sectors like electronics and defense.

Tariff Truce Continuation

The deal strives to prolong the Geneva tariff standstill, dodging a steep climb where US tariffs might soar from 30% to 145% and Chinese ones from 10% to 125% by August 10, 2025.

Rare Earth and Magnet Supply

China committed to funneling rare earths and magnets to the US, confronting America’s reliance on Beijing’s commanding hold over these resources. Firms like JL MAG Rare-Earth, Innuovo Technology, and Beijing Zhong Ke San Huan secured export licenses to make it happen.

Educational Exchange

The pact safeguards Chinese students’ access to US universities, a striking exception amid tightened visa rules.

Progress aside, this remains a skeletal framework—some pieces still up in the air—awaiting the presidents’ approval. No follow-up sessions are slated, though both parties vowed to keep lines open to wrestle with economic sticking points.

Table: Key Provisions of the US-China Trade Deal

| Provision | Details | Implications |

|---|---|---|

| Easing Export Controls | US to soften tech/goods restrictions; China to relax rare earth/magnet limits | Cuts short-term trade hurdles but sidesteps the enduring tech standoff |

| Tariff Truce | Extends May 2025 Geneva pause, averts tariff spikes by August 2025 | Keeps trade steady yet leaves hefty tariffs (US: 55%, China: 10%) untouched |

| Rare Earth/Magnet Supply | China to deliver to US; named firms licensed | Eases US reliance but spotlights China’s sway over vital supplies |

| Educational Exchange | Chinese students to attend US universities | Upholds cultural bridges despite visa clampdowns elsewhere |

Market Reactions and Global Response: From Wall Street to Beijing

Official Statements

President Trump radiated confidence, declaring on Truth Social that the deal “is done” and touting an “excellent” US-China rapport. Chinese state outlet Xinhua painted the discussions as “professional, rational, thorough, and frank,” acknowledging a deal in principle while nodding to lingering loose ends.

Market Response

Financial markets greeted the news with guarded optimism—MSCI’s Asia-Pacific index ticked up 0.57%, a sigh of relief at dodging worse conflict. Yet the modest rise betrays investor wariness over whether the deal will stick and hold weight.

Analyst Perspectives

Analysts split on the takeaway. Some, like Henrietta Treyz of Veda Partners, suggested the talks mostly held the line—hours consumed by translation and rehashing old ground, a sign of stubborn roadblocks. Others flagged that the deal skirts thornier disputes, from Trump’s solo tariff moves to China’s state-steered economy, casting it as a stopgap rather than a cure.

Decoupling in Motion: Where US-China Relations Stand Today

Ongoing Decoupling Efforts

This trade pact unfolds as the US and China drift further apart strategically, propelled by economic sparring and security jitters. Key threads include:

- Visa Restrictions: The Trump administration has clamped down on visas for Chinese students, targeting those with ties to the Communist Party or sensitive fields. Nearly 1,300 Harvard students alone felt the pinch, stirring broad unease.

- Semiconductor Controls: The US has choked off advanced chip-design software sales to Chinese companies and flagged risks in using chips like Huawei’s Ascend AI, citing security breaches.

- Rare Earth Dependencies: China’s iron grip on rare earths sparked export curbs after US tariffs, unresolved despite Geneva’s promises. The US leans on one lone mine in Mountain Pass, California—a glaring weak spot.

Impact of Decoupling

The rift’s effects bite deep. China’s US exports cratered 34.5% in May 2025, and the World Bank slashed its 2025 global growth outlook to 2.3%, blaming trade strife. Experts like Elizabeth Economy see both nations locked in a “strategic decoupling,” trust frayed and hostility mounting.

The Deal’s Role in Decoupling

The agreement feels like a calculated play to handle urgent needs—rare earths above all—rather than a retreat from decoupling. Securing China’s supply gives the US a window to scout alternatives, while student exchanges keep a thin cultural thread alive. Still, it dances around the big clashes—tech races, trade habits—hinting at a managed coexistence, not a reunion.

America’s Manufacturing Comeback: Strategy, Spending, and Challenges

Investment Surge

The US is charging ahead to resurrect its manufacturing might, pulling in cash from near and far. Recent wins include:

- TS Conductor: A $134 million South Carolina plant for cutting-edge carbon-core conductors, yielding 462 jobs.

- Mitsubishi Electric Power Products: An $86 million Pennsylvania facility for switchgear.

- Apple: A $500 billion, four-year push to grow US manufacturing and research, adding 20,000 jobs in engineering and AI.

- Hyundai, TSMC, Eli Lilly: Fresh commitments to US factories, spurred by Trump’s tariff hammer.

America First Investment Policy

Unveiled February 21, 2025, the “America First Investment Policy” courts foreign investment from friends while freezing out foes like China. It smooths the path for nations like Canada, Germany, and Japan, fueling a $227 billion FDI boom in 2023—manufacturing the star performer.

Industrial Policy Resurgence

The US has doubled down on industrial policy to shore up critical sectors. The Inflation Reduction Act dangles tax credits for renewable energy firms, potentially doubling profits by 2025. Other moves include:

- Semiconductor Support: A 40% refundable tax credit for chip gear and a $10 billion fund to match state incentives for foundries.

- Workforce Development: Training initiatives for high-tech skills, confronting the 60% of manufacturers who rank talent shortages as their top headache.

Challenges and Criticisms

Headwinds persist. Critics warn that steep tariffs—10-49% unveiled in April 2025—might not resurrect manufacturing and could inflate costs, given tangled supply chains and global rivals. Skill deficits and creaky infrastructure also loom as hurdles to sustained growth.

Conclusion

The US-China trade deal of June 2025 marks a wary bid to steady economic ties, meeting immediate demands like rare earth access and tariff calm. Yet it plays out amid a grander shift toward decoupling, as both powers chase autonomy in tech and resources. At the same time, the US taps global funds and industrial muscle to recharge its manufacturing base, eyeing economic resilience and less dependence on China. Whether this bears fruit hinges on deft execution, diplomatic agility, and weathering relentless geopolitical strain. As the US and China navigate their tangled dance, the world economy braces for the aftershocks of their choices.

Key Citations

- US, China reach deal to ease export curbs, keep tariff truce

- U.S. and China Agree to Resume Trade Truce After Tensions Escalated

- China-U.S. decoupling continues amid visa, semiconductor restrictions

- New U.S. Factories Announced in March 2025

- America First Investment Policy takes aim at China, welcomes allied firms

- Companies announced intention to increase US manufacturing