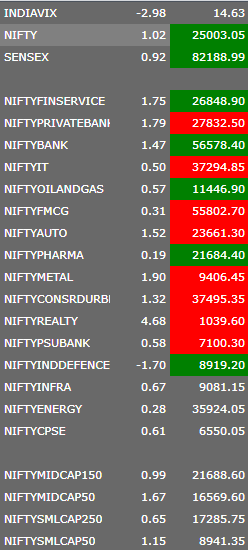

Bulls Take Charge on Dalal Street: NIFTY Scales New Heights Above 25,000, SENSEX Surges Past Historic 82,000 Mark Amid Broad-Based Buying Rally

In a superb trading session, Indian equity markets witnessed a powerful rally, with the NIFTY closing above the 25,000 mark and the SENSEX soaring past 82,000. The bullish momentum was driven largely by the Reserve Bank of India’s surprise move to reduce the repo rate by 50 basis points and a 100 basis points reduction in the Cash Reserve Ratio (CRR), signaling a pro-growth stance and igniting investor optimism.

Markets had been in a phase of long consolidation over the past few weeks, with participants awaiting a strong catalyst, and they got one.

”The rate cut not only improved liquidity sentiments but also reinforced hopes of a revival in credit growth, especially in rate-sensitive sectors like realty, banking, and autos, which saw sharp gains throughout the day.”

Sectors that moved the market: The real estate sector led the gains, with the Nifty Realty index rising over 4%. This surge was fueled by expectations of increased demand and improved affordability due to lower interest rates.

The financial sector saw robust performance, with major players like Bajaj Finance and Axis Bank among the top gainers. The rate cuts are anticipated to boost credit growth and profitability in this sector.

The metal sector also experienced gains, with companies like JSW Steel benefiting from the positive market sentiment and expectations of increased infrastructure spending.

The auto sector advanced by approximately 1%, with companies like Maruti Suzuki seeing significant gains. Lower financing costs are expected to stimulate vehicle sales

Overall, the market rally was broad-based, with all sectoral indices closing in the green, reflecting widespread investor optimism following the RBI’s policy announcements.

FNO Top Gainer/Loser:

Gainers:

IDFC First Bank emerged as the top gainer in the Futures & Options (F&O) segment, marking a significant uptrend in its stock performance, closing at ₹71.53, up from the previous close of ₹67.71, reflecting a gain of approximately 5.6%.

ICICI Lombard General Insurance Company Ltd. (ICICIGI) also emerged as a significant gainer in the Futures & Options (F&O) segment, with its stock price experiencing a notable surge. The stock closed at ₹2,006.20, marking a 6.86% increase from the previous close of ₹1,877.50.

Losers:

Sona BLW Precision Forgings Ltd. (SONACOMS) declined by approximately 3.3% during the trading session. Analysts attribute this downturn to profit-booking activities following a recent uptrend.

Solar Industries‘ shares fell by approximately 3.07%, despite the company recently hitting a 52-week high. The decline is likely due to investors locking in profits after a strong rally over the past year.

Sector Update:

Learnings for traders and retailers:

- Don’t focus on making money; focus on protecting what you have.

- Amateurs think about how much money they can make. Professionals think about how much money they could lose.